How to Build Wealth in a Volatile Stock Market

Editor’s note: “How to Build Wealth in a Volatile Stock Market” was previously published in June 2025. It has since been updated to include the most relevant information available.

The stock market has been anything but steady this year.

Since Donald Trump took office as the 47th President of the United States in late January, investors have endured a dizzying ride.

At first, markets stayed quiet – flat for about a month. But that calm quickly turned into chaos.

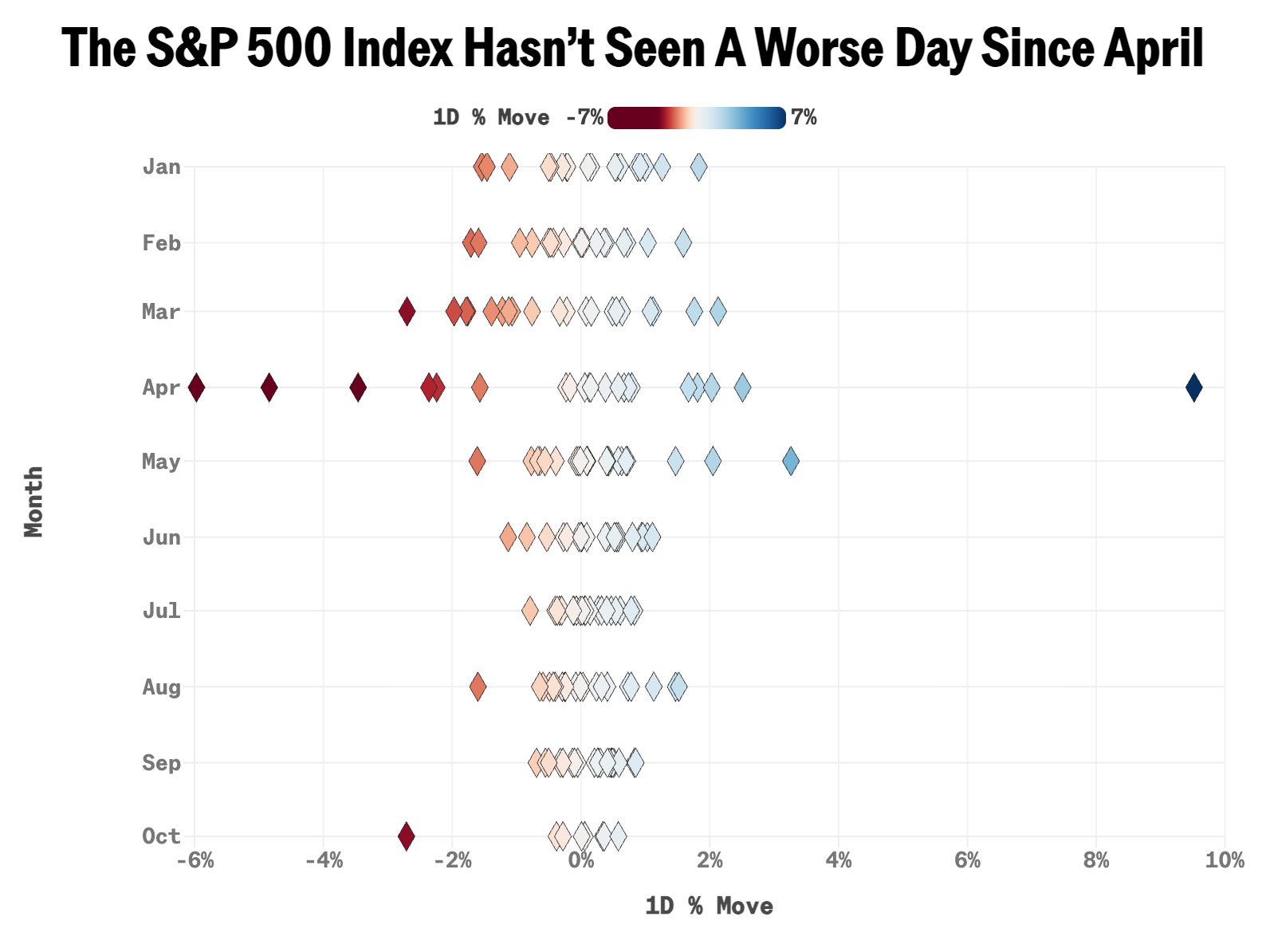

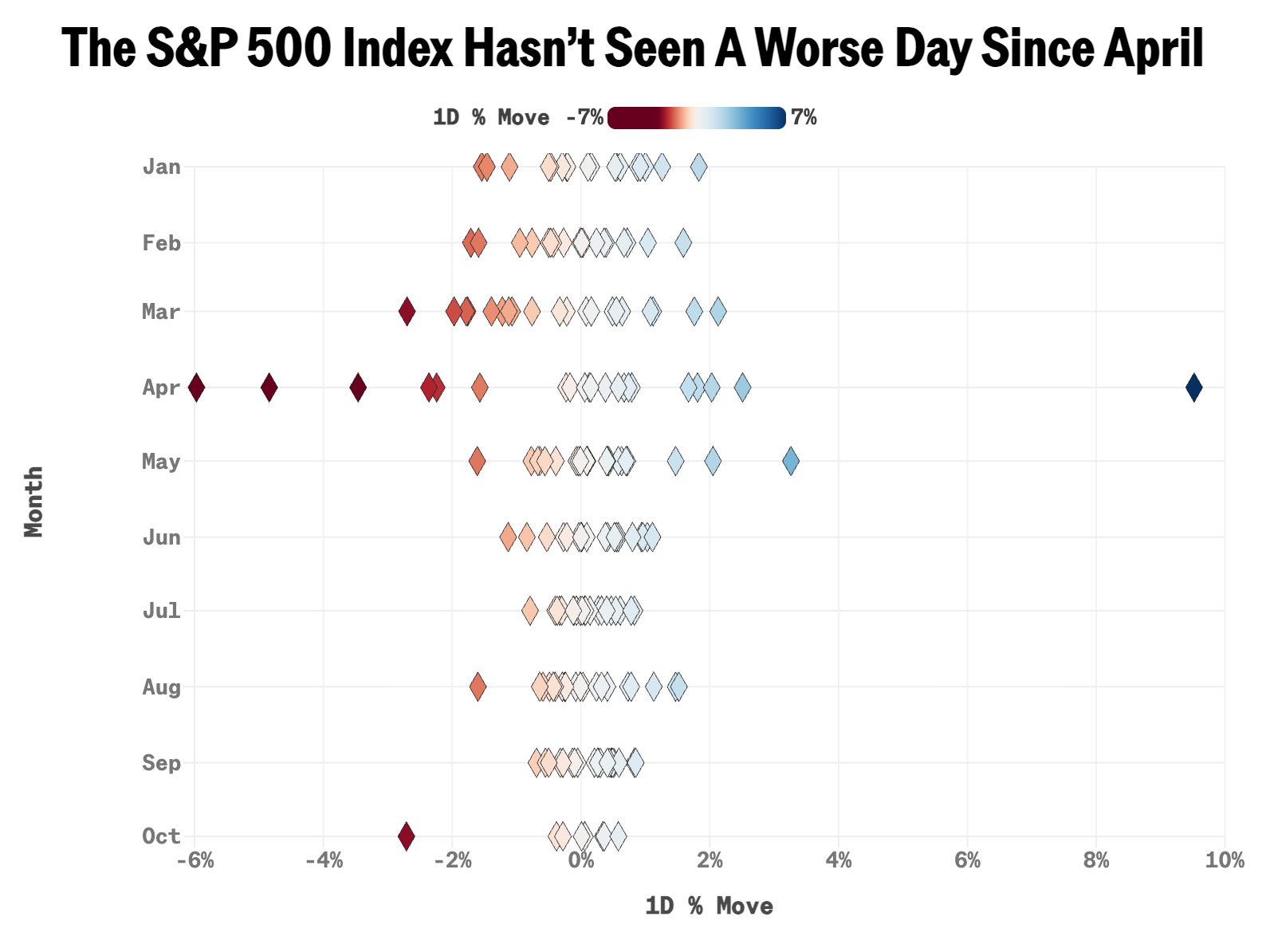

From mid-February to mid-March, the S&P 500 plunged 10% in just 20 trading days. Analysts blamed growing fears that Trump would ignite a global trade war. Those fears were realized on April 2, when Trump launched his “Liberation Day” tariffs. The move triggered a historic two-day, 10% drop in the index – marking the fifth-worst two-day crash on record.

Then came the snapback.

One week later, Trump announced a 90-day pause on those same tariffs. The market roared back. The S&P 500 surged 9.5% in a single session – the start of a massive 20% rebound over the next month.

In just 90 days, stocks had crashed 20%, then fully rebounded.

Until October 2025… and another sharp drawdown…

The Latest Trump-Induced Market Whiplash

After China tightened exports on rare earth metals, Trump took to social media to retaliate. The president said he was mulling a “massive increase” to tariffs on Chinese imports, as well as “many other countermeasures.”

That fresh threat led markets to panic. Tech sold off. And the Dow Industrial Average, Nasdaq, and S&P 500 all had their worst day in six months.

But in true 2025 fashion, the chaos didn’t last long. Within 48 hours, Trump took to Truth Social again – this time walking back his comments, saying trade relations with China “will all be fine.”

The market’s reaction was immediate. The Dow jumped 505 points (1.1%). The S&P 500 climbed 1.3%, retracing nearly 40% of its loss, and the Nasdaq popped 1.7% as beaten-down tech stocks led a powerful rebound.

It was yet another whiplash moment in what has arguably been the most volatile and violent stock market ever. And given that Trump has been the trigger – and that he will be in the White House for the next four years – investors are naturally asking themselves:

Is this intense volatility Wall Street’s ‘new normal’?

It may be…

A Bumpy Ride Higher: Why We Expect Stock Market Uncertainty to Continue

Don’t get me wrong. I think stocks are going higher over the next few years.

We’re somewhere in the middle of the AI Boom. Tech booms like these tend to last five to six years or longer. Just look at the Dot Com Boom, which started in 1995 and lasted through 1999 – five years of strong gains. The Nasdaq Composite rose about 582% during that time, while the S&P nearly tripled.

This AI Boom started in 2023. I think we have another two to three years of exceptional growth left in AI stocks. And that growth should drive the whole market higher.

However… I don’t think it’ll be a smooth ride higher…

Largely because of U.S. President Donald Trump, who promises to change a lot of things.

He wants to renegotiate trade deals and restructure global trade, rethink America’s global military presence, and cut federal spending. He wants to reduce taxes, expand America’s borders, and reshore manufacturing activity, among other things.

Clearly, he aims to change a lot.

Now, I won’t offer an argument as to whether these proposed changes are good, bad, or neutral.

But I will state the obvious: It’s a lot of change. And change is uncomfortable – especially for investors…

Because change equals uncertainty. That doesn’t mean this policy shakeup won’t push stocks higher in the long term. It may.

It simply means that, along the way, stocks will continue to be volatile – just like they’ve been throughout 2025.

Stock Market Volatility by the Numbers: Record-Breaking Swings Under Trump

Since Trump was inaugurated earlier this year, we’ve seen:

- One of the fastest 10% drops

- Following the announcement of the “Liberation Day” tariffs on April 2, the S&P sharply declined, dropping over 12.1% in the subsequent four sessions.

- One of the worst two-day crashes

- On April 3-4, the market suffered a 10.5% setback, marking the fourth-worst two-day stretch since 1950.

- One of the best single-day rallies

- Following President Trump’s announcement of a 90-day pause on recently implemented tariffs, the S&P surged 9.5% on April 9, marking its strongest one-day performance since October 2008.

- One of the best win streaks

- On May 2, the S&P locked in its ninth straight day of gains – the longest winning streak in more than 20 years – rising roughly 10% over that stretch

- One of the highest readings for the volatility index

- The CBOE Volatility Index (VIX), often referred to as the market’s “fear gauge,” nearly doubled over six months, reaching a reading of 27.86.

And all that in the span of three months…

If you think things will “mellow out” over the next 45 months, we think you’re sadly mistaken.

The Strategy for Surviving and Thriving in Today’s Market

Clearly, Trump isn’t playing around in his second term. He means business and intends to execute his vision, regardless of the short-term pain it may cause. That means that the volatility we’ve seen so far will likely persist throughout his tenure.

If you’re a buy-and-hold investor, that might sound scary. But that’s why I think you must become more than a buy-and-hold investor…

Because this volatility isn’t going away – not with a president who moves markets with a single post. But while most investors are getting whipsawed by these swings, some are quietly turning the chaos into opportunity.

In times like these, it’s not enough to simply “buy and hold.” You need a system that can adapt in real time – one that thrives on volatility instead of fearing it.

That’s exactly what my colleague Keith Kaplan and his team at TradeSmith have built. It’s called The Super AI Trading System: a fully automated portfolio designed to identify the five highest-conviction trades in the market at any given moment… and execute them with up to 85% historical accuracy.

This system reacts instantly to market turbulence, turning every shock, tweet, or tariff tantrum into an opportunity to buy low and sell high. In backtesting, it averaged 374% annualized returns over the past five years – even through pandemics, crashes, and political firestorms.

Keith will reveal everything tomorrow, Wednesday, October 15 at 10:00 a.m. Eastern Time during The Super AI Trading Event.

If you’ve been looking for a way to make money in wild markets like this, this is it.

Click here to reserve your spot now.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.