The Secret Behind Warren Buffett’s KO Deal

In 1993, Warren Buffett pocketed $7.5 million instantly. Here’s how you can adapt his playbook.

Editor’s Note: One of the things I love most about our InvestorPlace community is the chance to connect you with ideas and tools that normally sit behind hedge fund walls. Today, my colleague Keith Kaplan from TradeSmith is pulling back the curtain on a strategy inspired by Warren Buffett himself – a simple principle that’s helped the Oracle of Omaha generate steady cash for decades.

Keith has been working on a breakthrough tool called the “T-Line,” and he’s unveiling how it works at his upcoming T-Day Summit. Read on to learn how this could be a game-changer for everyday investors.

With that, let’s hear directly from Keith…

Imagine making $7.5 million – instantly.

It sounds wild… impossible even.

But that’s what Warren Buffett did in 1993, using a special cash-generation technique.

Buffett is widely considered the greatest living investor. At the age of 10, he bought his first stock. By his early 30s, he was a millionaire.

When he was 35, he bought into a struggling textile firm called Berkshire Hathaway. He paid just $7.60 a share. Today, a single Class A share sells for more than $700,000. That’s a 9,200,000% gain in value.

It’s no wonder that Business Insider identified at least seven people or families who became billionaires because of early stakes in Berkshire Hathaway Inc. (BRK.A, B).

You’ve probably heard Buffett’s Rule No. 1: Never lose money. And his Rule No. 2: Never forget Rule No. 1.

But there’s also an unspoken Rule No. 3 that he’s practiced for decades: Always look to generate income in addition to long-term gains.

He does it using something I call the “Buffett cash secret”…

Investing Like Warren Buffett

Most individual investors don’t know about this, but it’s made Warren Buffett staggering sums of income.

And it isn’t reserved for billionaires like Buffett. With the right tools, you can use the same principle to generate steady income.

In 2021, my team and I at TradeSmith launched an automated strategy that replicates Buffett’s cash secret.

Our proprietary algorithm looks at millions of data points over thousands of stocks. It uses historical data to tell us what’s the probability of something happening today. And it’s made TradeSmith users a lot of money.

From December 2020 through July 2021 I tested the system. And I used it to collect an average extra income of $1,388 a week. That’s like an extra paycheck every week.

And by the end of the year, hundreds of TradeSmith users were reporting consistent weekly payouts.

For example, a veterinarian named Brad reported making $4,500 in his first month. He said every single trade paid off – with zero losses.

And here’s what a user named Patrick wrote after using our strategy…

I used to struggle just to make back my losses. Now, thanks to these tools, I’ve made consistent six-figure gains – and I’m taking my family on an Alaskan cruise.

Or take Ron, a surgeon from Ventura, Calif. He wrote in on New Year’s Day 2022 to say he’d made more than $1 million in the last half of 2021…

This is the greatest thing I’ve ever seen or used. The last 22 weeks of the year has made me $1,137,488.

Today, at 884 trades and counting, our win rate stands at 98.8%. And it’s not too late to harness the power of this strategy to move the needle on your wealth.

In fact, as I’ll show you today, it’s about to get better than ever.

That’s thanks to a breakthrough software tool we’ve developed. It lets you systematically slash the kinds of risks that are keeping too many folks treading water with traditional buy-and-hold…

While giving you massive upside potential in this lucrative trading niche.

Warren Buffett’s No-Lose Deal

Buffett has long been a huge fan of Coke.

By his own count, he drinks about five cans a day. At one Berkshire annual meeting, he even joked, “I’m one-quarter Coca-Cola.”

And he’s been buying shares in Coca-Cola Co. (KO) since the late 1980s.

In 1993, Buffett wanted to add to his position. But at $39 a share, KO was trading for more than he was willing to pay. So he struck a different kind of deal.

He promised he’d buy 5 million shares of KO if it fell to $35. This helped investors hedge the risk of holding this stock. In return, he collected $7.5 million in cash immediately.

From there, Buffett’s cash secret scaled into the billions. In 2007, Berkshire’s annual report showed 94 cash-generating contracts that made him $7.7 billion in upfront cash.

Buffett has massive firepower to make this cash secret pay off like that. But how does the potential for an extra $600 a day sound?

That’s what one user of TradeSmith’s automated cash-generation strategy, Ian W., told us he makes.

Other users report gains like these:

This strategy has been netting me $5,000 to $10,000 monthly!

– Marion B.

I manage to average about $250,000+ a year. I consider that my annual salary.

– Yvon L.

I set a low monthly target of $5,000 gain… For the first seven weeks in 2025, I was fortunate to harvest $15,000.

– Mark C.

These are some of the best results users have reported with our system. And they’re the kinds of success stories I love to hear. But my team and I at TradeSmith haven’t been resting on our laurels.

Since 2021, we’ve been working toward a bigger, wilder goal to help even more people. Now, it’s ready to be revealed – a new way to apply Buffett’s Rule No. 3.

It’s called the T-Line. And I’ll be unveiling what it does, and how you can use it to pull cash from the markets, at The T-Day Summit on Tuesday, September 30, at 1 p.m. ET.

And I couldn’t be more excited, because the T-Line redefines how everyday investors can generate cash in the market.

Here’s a sneak peek…

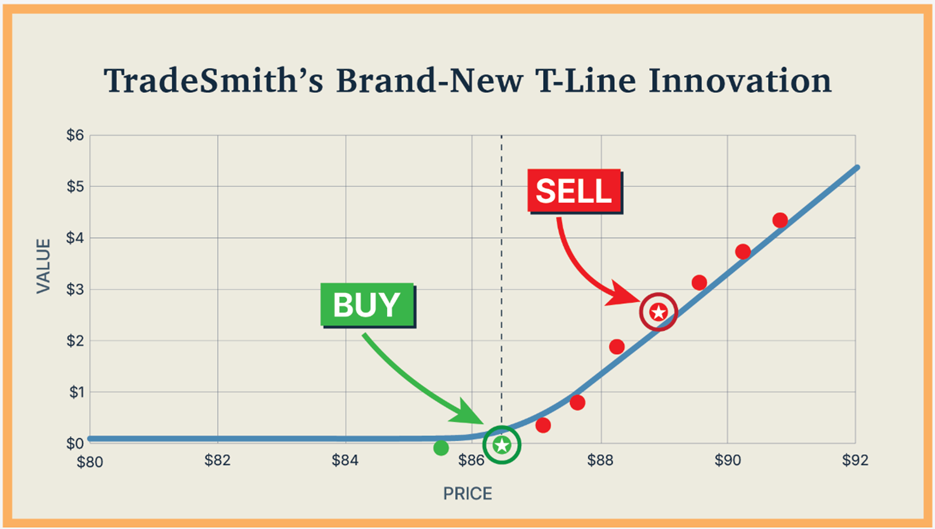

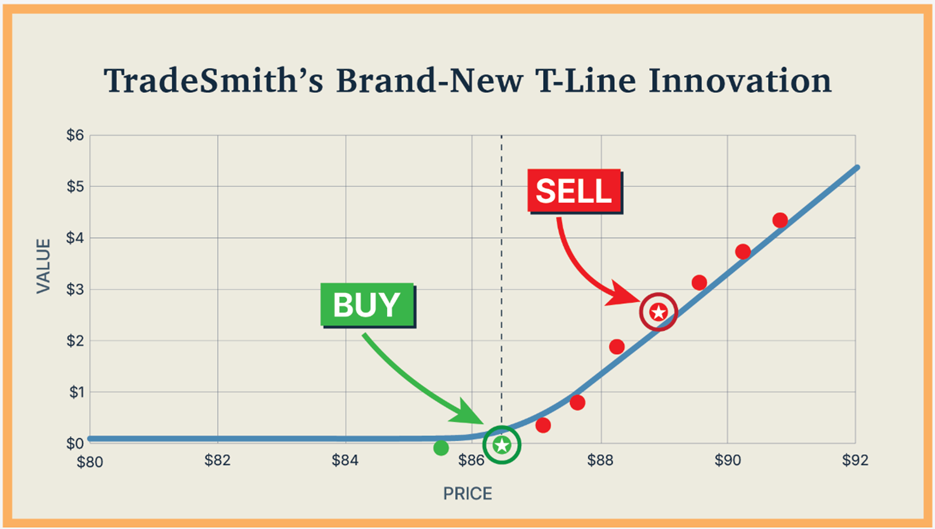

Buy on Green, Sell on Red

See those green dots below the line and those red dots above the line?

That’s what the breakthrough new software tool I mentioned up top looks at. This chart shows you the T-Line at a glance, making it simple to spot mispricings.

If I want to generate upfront cash, I look up virtually any stock and see which of the dozens of possible trades I should make by arranging them either above or below the line.

If it’s a green dot below the line, I buy. If it’s a red dot above the line, I sell. It’s that simple.

And on Tuesday, September 30, at 1 p.m. ET, I’ll show how these dots add even more firepower to the kind of trading that’s already helping our users collect short-term income.

You’ve already head some of their success stories – and that’s from using our system without the T-Line. It now gives them the power to shorten these trades from one week down to just one day in many cases.

That’s why I hope you’ll reserve your seat now for our T-Day Summit. I’ll walk you through how the T-Line works and how you can use it to generate your own extra income streams.

I’ll also…

- Show you real-world examples of trades you could make right away.

- Reveal how to cut your risk while boosting your potential returns.

- And share more stories from everyday investors already using this approach.

I’ll even give you a free blueprint you can use immediately after the event.

To reserve your seat, go here now.